|

Discussing Motorcycle Insurance As A Necessity Some may think owning a motorcycle is easy, but what many do not realize is that this mode of transport requires almost the exact same requirements as a car, and included in the list of things to do, is the need for insurance. How Does Motorcycle Insurance Work According to the Bureau of Statistical Information, the United States has over 885,000 motorcycles on the road in 2007, and it can be safe to deduce that this number has increased over the years. The laws regulating motorcycle use, age, licensing, and training do vary, but the main thing to keep in mind is that insurance is a major factor that cannot be ignored. Before purchasing a motorbike, most riders are encouraged to take part in a motorcycle safety course upon which they receive a certificate. This often works to lower their premiums as many companies offer large discounts upon presentation of this certificate. Other discounts may depend on age, including insurance companies that offer more competitive rates to riders over the age of 50, while others specialize in ensuring younger riders. To get the best motorcycle insurance Lake Charles insurance companies have to offer means understanding the options available by exploring the coverage options available. Types of motorcycle insurance Lake Charles companies sell Liability insurance is the most basic form which normally covers the bodily injury and possible damage that may be caused to the property of a 3rd party. This does not cover the rider, but rather focuses on the other party with whom the rider may have collided with. It may also cover injury to a passenger rider, depending on the insurance company and laws of the area within which such an accident may happen. Motorcycle Collision Insurance covers the damage to the motorbike upon collision with another vehicle, which means the company will usually pay for damages amounting to the book value amount of the bike minus deductibles. Comprehensive Coverage in contrast with the above Motorcycle Collision Insurance pays for damages caused by anything other than a collision with another vehicle, such as theft, fire, or vandalism, covering the book value of the bike. Personal Injury Protection which pays for the medical bills of the rider, passenger, and pedestrians who may be involved in an accident. This is usually offered on as an ‘add-on’ and may not necessarily be available across the country. There are other disclaimers and additions to this insurance coverage such as Coverage for Customized Parts which will compel a insurer to pay for more than the standard factory parts that a motorcycle comes with. There is also the Uninsured/Underinsured motorist coverage which would pay for personal injury caused or damage to property by another driver who does not have insurance and usually covers medical treatment and lost wages. Factors Determining Motorcycle Insurance Costs There are a number of things that may make one individual be liable to pay more insurance costs than another, and these include: - The age of the driver - The driving record of the driver - The area within which the driver lives - The age of the motorcycle - The number of miles the driver rides in a year - The storage of the bike These are just a few of the factors that contribute to the premiums involved in purchasing motorcycle insurance. Conclusion In conclusion, having motorcycle insurance is beneficial for both the rider and those in their environs. It protects owners from having to face major costs after an accident that could be financially devastating. Most states in the U.S require proof of insurance before registering a motorcycle and getting a license plate, meaning insurance is a solution that may keep one from ending up in the dirt. TAGS: Motorcycle Insurance - Bike Insurance - Dirt Bike Insurance - Off Road Bike Insurance - Lake Chalres, LaIf you own a home or car, it is imperative that you renew your homeowners and auto insurance. When considering renewal, you might come across a number of options that will help you make sure that you have the coverage you need at a good price. There are numerous Lake Charles auto insurance options, where you can find an agent for auto, home, business insurance, and obtain policies that come with the largest discounts. 1. Auto Insurance You need auto insurance any time you own a car, but you should search for insurance that offers discounts. These discounts could be in the form of multi-policy, good driver and in some instances, carriers offer accident forgiveness. Understanding your auto insurance and which repairs should come out of your pocket versus submitting a claim, can help you avoid spending too much. You should ask if there is a way to structure your insurance to save money. For instance, if you can afford to, you might find that choosing a plan with a higher deductible drops your rate significantly. 2. Home Insurance Storm-resistant windows, shutters, home security systems and monitoring. According to the III, hail and wind were the #1 cause of loss in 2016. Nearly 1 in 40 homes has an insurance claim in this category every year. While not inexpensive to upgrade, hurricane resistant glass and roll-down shutters help prevent wind damage associated with hurricanes and tropical storms. A home security system is another upgrade homeowners can usually make to reduce risk of loss from burglary and secure homeowners insurance discounts. Home security falls under protective device discounts and could include something as simple to install as door sensors and smoke alarms. Before making voluntary upgrades to your home, consult with an insurance agent about the type of system you are considering and how and if it will impact your policy coverage and potential discounts. Certain requirements and standards may be required for eligibility, and not every state or carrier offers discounts for these upgrades. They might flip you to their car insurance plans, and you will get a policy discount because you have more than one policy. 3. Multiple Policy Discounts You may be surprised to learn about multiple policy discounts. if you are trying to save money, ask the company how much money you can save by bundling your auto and homeowners insurance. It could be as easy as get a discount every time you add a car or a home with a current carrier. 4. How Long Do The Policies Last? Typical auto insurance policies are renewed every six months. Homeowners insurance are usually quoted for a year, however, most homeowners don’t shop insurance very often and once in place they generally stay with the same company until they sell or refinance their home. That is why is important to shop for the best rates on your homeowners insurance initially. 5. Call Your Agent The best insurance agents are aware of the discounts available to their clients from their various insurance carriers. If you are serious about saving money on your auto and homeowners insurance, dedicate an hour to go over your insurance needs with an agent. Allow them time to ask the questions need, and give them honest answers. It is their job to help you manage your risk, while saving you money. To Conclude The auto, home, and business insurance that you buy from your agent should be tailored to your situation. You can ask for auto insurance Lake Charles options that are actually affordable, or you could look at options that you believe would be best for you. You could buy a policy that has a very low deductible, or you could get something with a low premium that makes the monthly payments easier to handle. To learn more, schedule a consultation with Kelly Lee Insurance, your best option for home and auto insurance in Lake Charles, La.

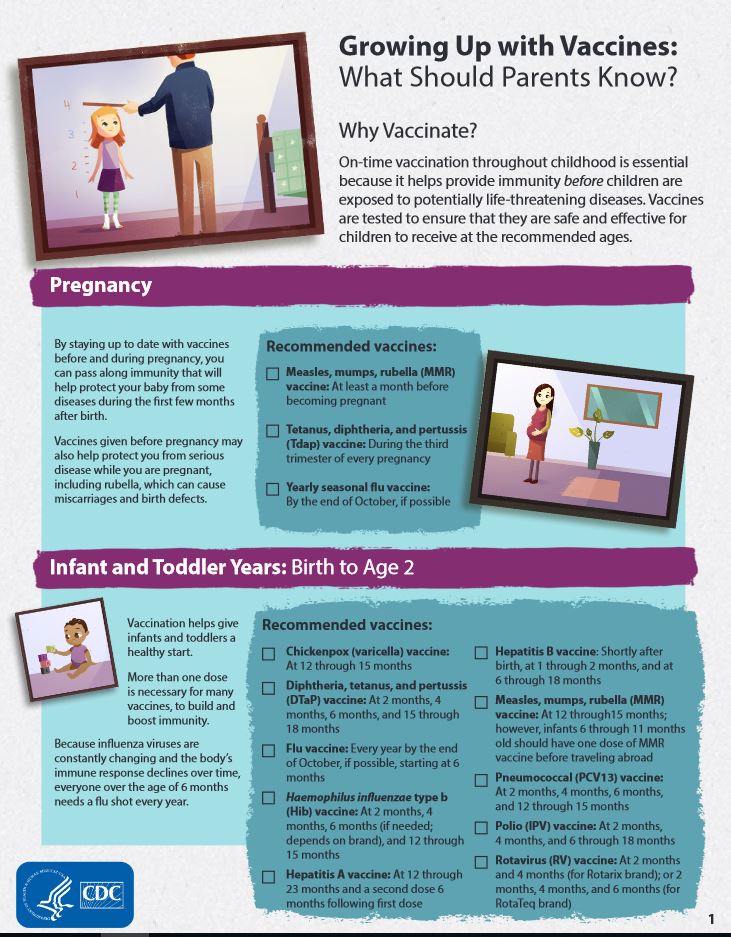

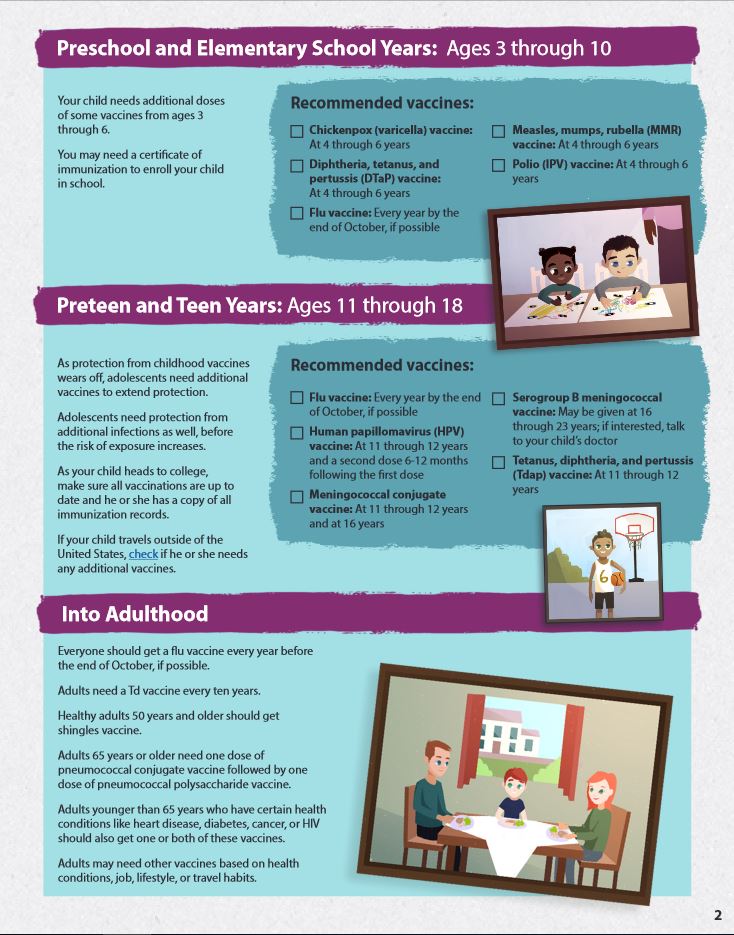

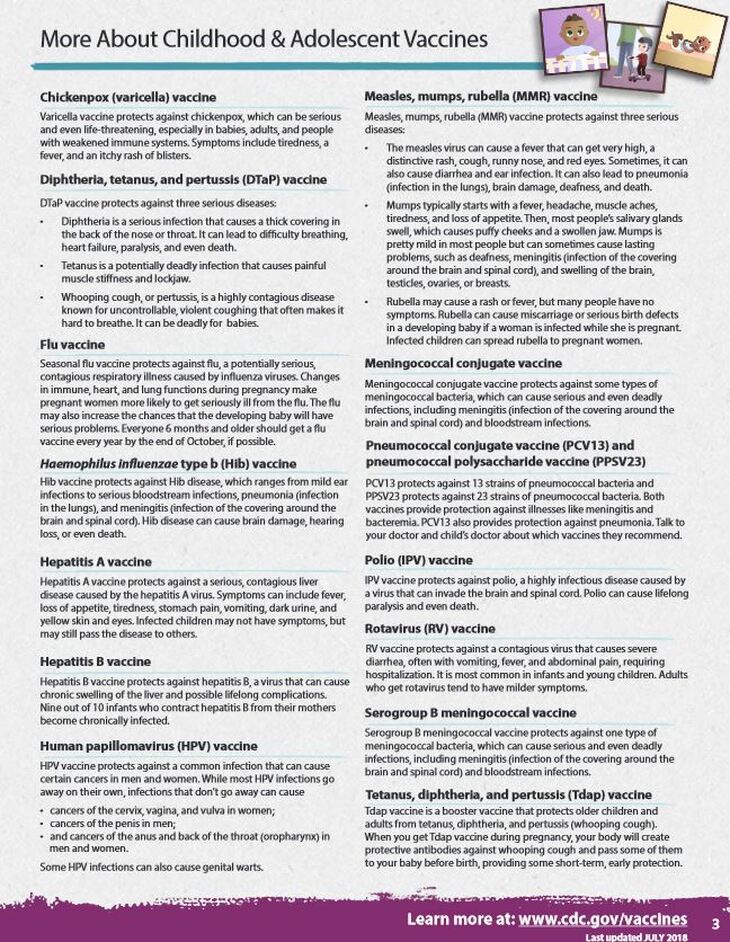

How You Can Save Money on Home and Auto Insurance?Car Insurance Lake Charles La, Home Insurance Lake Charles La, Insurance Lake Charles LaThe who, why and when of vaccines. 704 cases of measles, in 22 states have been confirmed in the United States since January 1st, 2019, This is the largest number of cases reported in then U.S.since measles was declared eliminated in 2000. With measles in the spotlight and on the rise, we thought we would share the following information from the CDC with our followers. Kelly Lee Insurance | Our Policy is Caring! | (337) 656-2890 TAGS: Growing up with vaccines, health insurance Lake Charles La, supplemental insurance Lake Charles La |

Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed